In the digital age, where online transactions have become the norm, ensuring the security and authenticity of these transactions is paramount. Enter the BIN checker – a tool that may seem obscure to the uninitiated but is incredibly valuable for anyone involved in media buying and virtual cards. This article aims to demystify BIN checkers, explaining what they are, how they work, and why they’re essential, especially in preventing fraud.

BIN stands for Bank Identification Number. It is the first six digits of a payment card number and serves to identify the issuing bank or financial institution. This number is crucial for processing transactions, as it helps in determining the card type, the network (like Visa or MasterCard), and the country of origin.

Why Use a BIN Checker?

A BIN checker is a tool that verifies the details of a BIN to ensure that a transaction is legitimate. You can find a BIN checker free tool using Google.

Here are some of the primary reasons to use a BIN checker:

- Fraud Prevention: By verifying the BIN, you can detect potential fraudulent transactions. For instance, if the BIN indicates a card is issued in one country, but the transaction is being made from another, it could be a red flag.

- Media Buying: In media buying, knowing the origin of a card can help in tailoring marketing strategies and campaigns. It ensures that the payments are coming from legitimate sources, maintaining the integrity of the media buying process.

- Efficient Transaction Processing: By quickly identifying the card type and issuer, transactions can be processed more efficiently, reducing the likelihood of errors and delays.

How to Use a BIN Checker

Using a BIN checker is straightforward. Here’s a step-by-step guide to get you started:

- Choose a BIN Checker Tool: There are numerous BIN checker tools available online. For this guide, we’ll use the BIN Checker free tool “Pulse” from PSTNET, known for its reliability and ease of use.

- Enter the BIN: Input the first six digits of the card number you want to verify.

- Review the Results: The BIN checker will provide detailed information about the card, such as the issuing bank, card type (credit, debit, prepaid), network (Visa, MasterCard), and country of origin.

- Analyze the Data: Use the information provided to verify the legitimacy of the transaction. If anything seems suspicious, further investigation may be warranted.

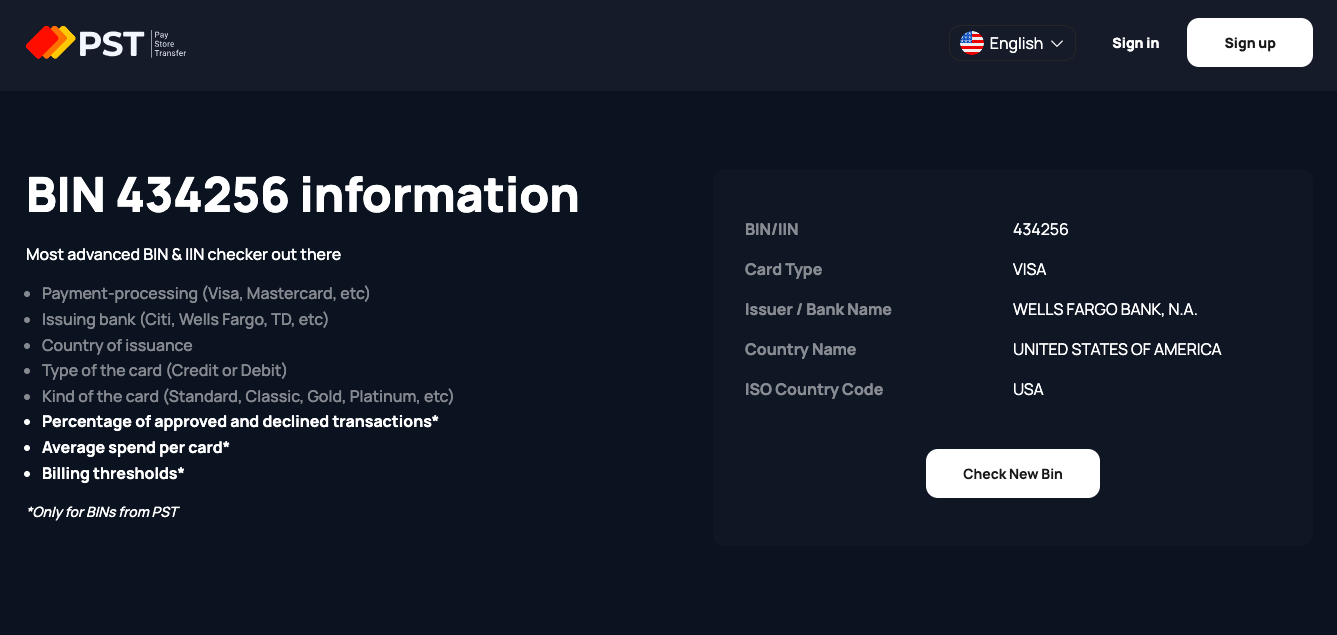

Let’s consider a practical example using the BIN 434256 with the BIN Checker tool “Pulse” from PSTNET.

After entering the BIN into the Pulse BIN Checker, the tool reveals that this BIN is associated with a Visa credit card issued by a well-known bank in the United States.

If you’re involved in media buying, knowing the card’s origin can help tailor your campaigns to target audiences more effectively. For example, if most of your transactions are coming from the US, you might focus your marketing efforts on American consumers.

Tips for Using BIN Checkers Effectively

- Regularly Update Your Tools: Ensure that your BIN checker tool is up-to-date. BIN ranges can change, and using an outdated tool might lead to inaccurate results.

- Combine with Other Tools: While BIN checkers are powerful, they should be used in conjunction with other fraud prevention tools and strategies for maximum effectiveness.

- Stay Informed: Keep yourself updated on the latest trends and developments in card fraud and media buying. This knowledge will help you make better use of BIN checkers and other related tools.

A BIN checker is an indispensable tool for anyone involved in media buying and virtual card transactions. By understanding how to use it effectively, you can enhance your fraud prevention measures, streamline transaction processing, and make more informed decisions in your media buying strategies. Whether you’re a complete beginner or looking to deepen your knowledge, this guide provides a solid foundation to start using BIN checkers with confidence.